SoFi Checking and Savings is raising the savings APY (Annual Percentage Yield) to 4.40%¹ for all members with direct deposit, up from 4.30%. Members with direct deposit will now earn 10x² the current national average savings rate on all their savings and Vaults balances.

As of today, SoFi checking balances will earn 0.50%¹ for all members, 7x³ the national average interest checking rate.

More details on our changes as of today:

What are SoFi Checking and Savings members earning across the board?

• Members with Direct Deposit:

◦ Savings: 4.40% APY, up from 4.30%

◦ Checking: 0.50% APY, adjusted from 1.20%

• Members without Direct Deposit:

◦ Savings: 1.20% APY, no change

◦ Checking: .50% APY, adjusted from 1.20%

Why have you made these changes to your APY?

Adjusting our APY to the new structure allows us to increase our savings APY even further while still offering an industry leading APY on checking balances.

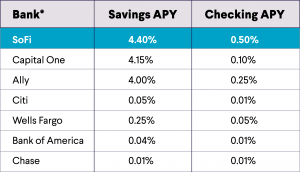

SoFi’s checking APY is 7x the national average, and see how we stack up vs. other banks⁴:

As always, members can make unlimited instant transfers between checking, savings, and Vaults.

What other benefits does SoFi Checking and Savings offer members?

SoFi offers members a variety of benefits designed to ensure members feel secure in their finances and can get their money right:

• Additional up to $2 million in FDIC insurance via the SoFi Insured Deposit Program⁵

• Autopilot transfers to automate recurring transfers between SoFi accounts

• Roundups to save the “spare change” from purchases towards members’ preferred savings goals

How do I set up direct deposit?

Simply download this pre-filled form, sign it, and submit it to your employer’s payroll department. Simple as that!

Alternatively, if your employer has an HR portal that allows you to set up direct deposit by inputting your account number and routing number, you can get those here.

DISCLOSURES

1. SoFi members with direct deposit can earn up to 4.40% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum direct deposit amount required to qualify for the 4.40% APY for savings. Members without direct deposit will earn up to 1.20% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 7/11/2023. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

2. 10x based on FDIC monthly savings account rate as of June 20, 2023.

3. 7x based on FDIC monthly interest checking rate as of June 20, 2023.

4. Rates may vary by state and do not account for bonus, special or promotional APYs. Comparison bank rates are current as of July 3, 2023.

5. SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per legal category of account ownership, as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $2M through participation in the program. See full terms at SoFi.com/banking/fdic/terms See list of participating banks at SoFi.com/banking/fdic/receivingbanks

The post Raise the Rate: SoFi Checking and Savings Increases Savings APY to 4.40% For Members with Direct Deposit appeared first on SoFi.

Leave A Comment