Given DeFi’s steady pursuit of replicating and improving financial services and products within a decentralized permissionless framework, it was only a matter of time until one of the biggest success stories in traditional finance of the last decades would see the creation of its decentralized counterpart: Indices and ETFs. In this article, we explain the advantages of investing in an index.

First, we have to define what an index is: In the financial world, an index is best described as a rules based investment strategy.

The most common investment strategy that is represented by an index is a dynamic basket. This type of index measures the performance of a set of assets that are selected and weighted according to the index methodology, where weights change with the price movements of the constituents.

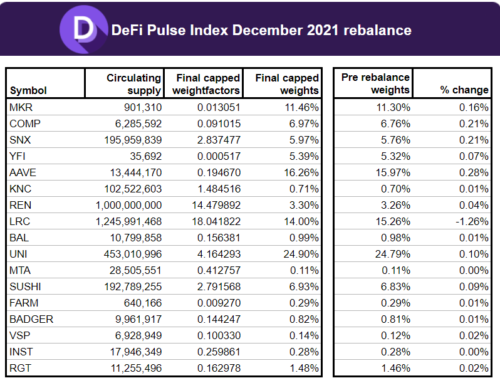

Simple examples are the S&P 500 Index that tracks the performance of the 500 largest publicly listed US companies or the DeFi Pulse Index, a digital asset index, that tracks the performance of some of the largest protocols in the DeFi space. In both cases, each index constituent is assigned a weight proportional to its market capitalization.

Diversification: The Holy Grail

Why can this strategy be a better investment than just buying one single asset? The best answer is a quote attributed to economist, Nobel laureate, and father of Modern Portfolio Theory Harry Markowitz:

“Diversification is the only free lunch.”

Almost everywhere in finance higher return implies higher risk. Diversification describes how the process of combining risky assets can create a portfolio that has lower risk than each of its single constituents. At the same time, the portfolio’s return simply remains the weighted average of the return of the constituents. Or phrased differently, lowering the risk doesn’t imply lowering the return.

UNIAAVEUNI + AAVE50/50DeFi Pulse IndexVolatility125%121%114%98%(Data source: Coingecko, Oct. 3, 2020 to Dec. 3, 2021, using daily returns)

What’s the intuition behind this?

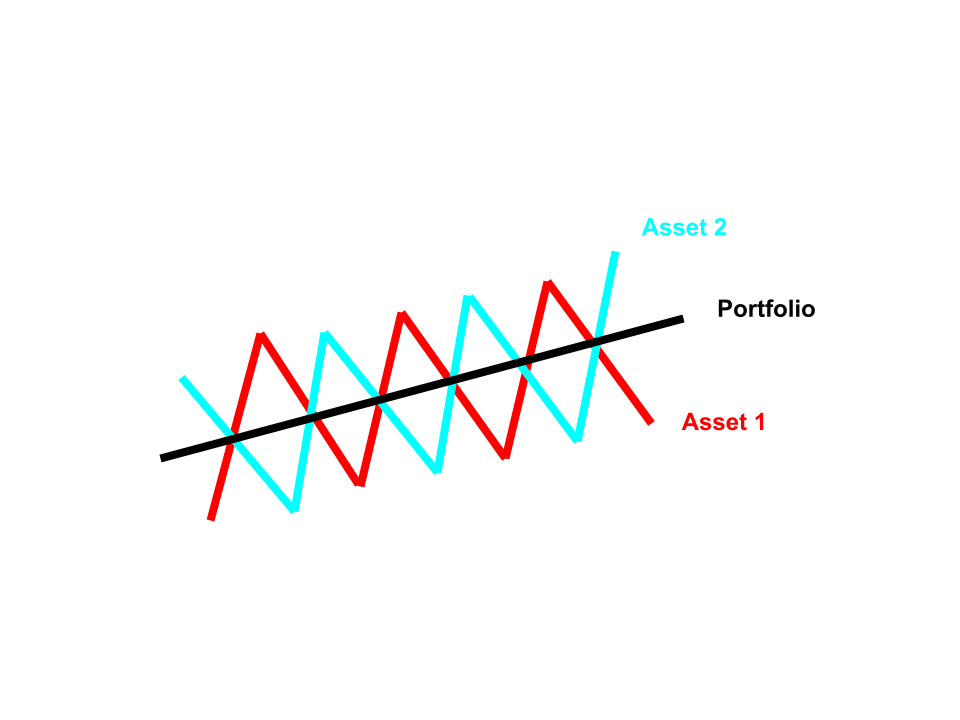

Imagine two assets that perfectly mirror each other: When one asset’s price goes up, the other asset price goes down an equal amount and vice versa. If you combine these two assets into an equal weighted portfolio, that portfolio’s performance would be a straight line — here just two assets would be sufficient to completely remove any price risk from the portfolio without giving up any return. How two assets behave relative to each other is the driver for the reduction of risk.

A more sophisticated explanation for how diversification works uses a factor model and starts with the premise that the risk of a financial asset can be decomposed in two types, systematic risks and specific risk (sometimes also called idiosyncratic risk).

Systematic risks refer to risks coming from common structural drivers, for example the economic risk of companies in a certain sector, the interest rate risk of highly leveraged companies, the risk of assets tied to a certain geographic region, or the default risk of small not yet profitable companies. Specific risk on the other hand is the risk directly tied to a specific company.

When combining several assets into a portfolio, the systematic risk of the portfolio is simply driven by the net exposure to systematic risk factors (e.g. the net exposure of the portfolio to a certain sector). The specific risk of the portfolio, though, decreases the more assets are added. Intuitively, as all the assets’ specific risks are independent of each other, their specific performance cancels each other out. The more constituents the portfolio holds, the more stable that cancellation is (flipping 100 fair coins will yield close to 50% heads and 50% tails with higher probability than flipping just two coins). The specific risk is “diversified away”.

Ray Dalio, who called diversification the “Holy Grail of Investing”, suggested that with fifteen to twenty good, uncorrelated return streams, you can dramatically reduce your risks without reducing your expected returns.

How about some formulas?

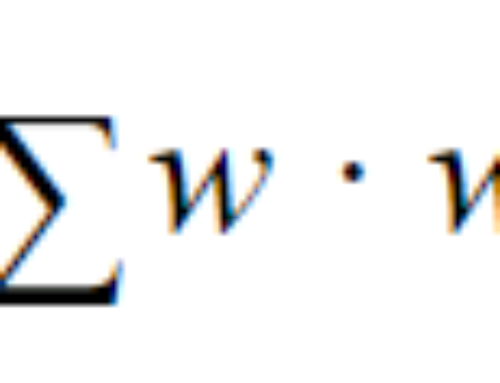

A mathematical explanation for risk reduction when combining assets can be found by looking at the definition of the volatility (σ) of a portfolio, here again for a simple two asset example with allocations w1 and w2 respectively:

Going back to our two-asset example from above, we can see that the relation between respective price movements, its correlation (ρ), determines the level of risk reduction due to diversification.

Only in the case where the two assets are perfectly correlated, , will the above formula simplify to , and the portfolio risk is just the weighted sum of the risks of each asset, i.e. there is no diversification. For any level of correlation less than 1 there is a portfolio allocation at which the portfolio risk is lower than the risk of each asset alone.

For example, UNI and AAVE had a realized correlation of 0.7 in the above example period.

So I have to buy 500 securities?

Firstly, no. Around this simple but powerful concept of diversification, a huge industry has developed that created new and innovative products. The goal was to make index investments available and accessible to everyone.

The final product iteration that achieved this goal was the exchange traded fund (ETF). ETFs are funds that can hold a broad range of asset classes (e.g. equities, bonds, derivatives), can be created and redeemed in the primary market (in TradFi only Authorized Participants can do this, in DeFi everyone can mint or redeem DPI or FLIs!), and are listed on exchanges to allow for secondary market trading. With just one transaction, buying one ETF or one index token, an investor can get exposure to a diversified basket.

Currently, almost $10 trillion are invested in ETFs globally and more than 2000 different ETFs are available in the US alone. As a result, retail investors are able to effortlessly gain exposure to securities covering all regions and major asset classes, as well as strategies that were limited to high net worth or institutional investors in the past. Flexible Leverage Indices are one example of a complex investment strategy, an automatically rebalancing collateralized debt position, that is made accessible as a simple token that can be bought and sold.

An almost free lunch

After hearing about the benefits of index investing, one might wonder how much this free lunch really costs. Luckily, by definition, investing in an index is cheap. Since an investor only has to buy or sell one product instead of executing many single transactions, transaction costs are lower. As assets are effectively pooled any other fixed maintenance fees are socialized.

Rebalancing, the process of changing the components and weights of an index, is wrapped into the index and therefore the index tracking product. Simply buying and holding is possible while maintaining an up-to-date exposure. No work and time is necessary to research and pick assets. Given that indices are mostly rules based, no active managers or performance fees have to be paid.

In summary: Indices provide exposure to systematic drivers of risk and return and reduce idiosyncratic risk thanks to diversification at little cost.

Pulse.inc, a subsidiary of DeFi Pulse, is dedicated to creating and maintaining indices for a decentralized world.

The post Why Invest in an Index? appeared first on Defi Pulse Blog.

Leave A Comment