A big Tuesday reversal in risk markets has seen bitcoin (BTC) climb nearly 10% from its weakest level of the session and the Nasdaq move into the green after being lower by nearly 2% earlier in the day.

Buffeted about by Trump’s tariff threats for weeks, stocks and crypto initially were sharply lower today as the levies against Mexico, Canada and China actually went into effect.

Dip-buyers emerged late in the U.S. morning, though, and with a bit more than an hour to go before the close of stock trading, the Nasdaq is sporting a 0.7% advance on the session. The S&P 500 has narrowed a large early loss to just 0.25%.

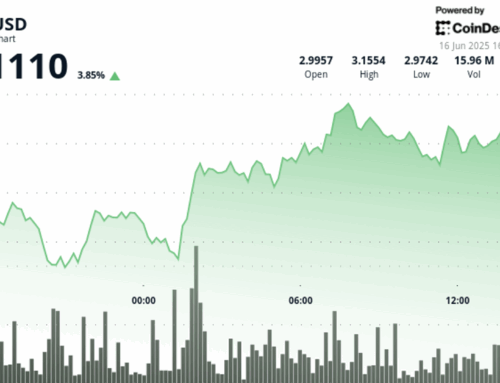

Trading just above $88,000, bitcoin is now ahead 1.5% over the past 24 hours. Ether (ETH) continues to underperform, flat over that time frame at $2,171.

Tuesday’s action continues a wild 10-day ride for bitcoin, which plunged more than 20% in about a six-day period from Feb. 21 to just above $78,000, only to rebound more than 20% to about $95,000 over the following three days before tumbling anew yesterday and this morning to the $81,000 level.

A check of crypto-related stocks today finds Strategy (MSTR) ahead 11%, Coinbase (COIN) up 4% and Marathon Holdings (MARA) with a 5% gain.

Green shoots?

It’s been a difficult few weeks for risk assets, but the downturn may also be creating the conditions for an eventual rebound.

It wasn’t long ago when markets had all but written off the chance for any Federal Reserve rate cuts in 2025 and the 10-year Treasury yield was threatening to rise above 5%. The tariffs, though, have combined with some weakish economic data and the tumble in markets to change that calculus.

Interest rate traders have now fully priced in three or more Fed rate cuts this year, with the first move coming as soon as May. The 10-year Treasury yield, in turn, has pulled back to 4.15% from 4.80% at the time of the Trump inauguration six weeks ago.

Leave A Comment