The latest round of tariffs between economic superpowers has particularly affected technology-related assets, with NEAR Protocol’s NEAR NEAR experiencing significant price volatility amid the uncertainty.

Meanwhile, central banks are navigating a complex landscape of slowing growth and persistent inflation concerns, creating a challenging environment for both traditional and digital asset markets.

Technical Analysis

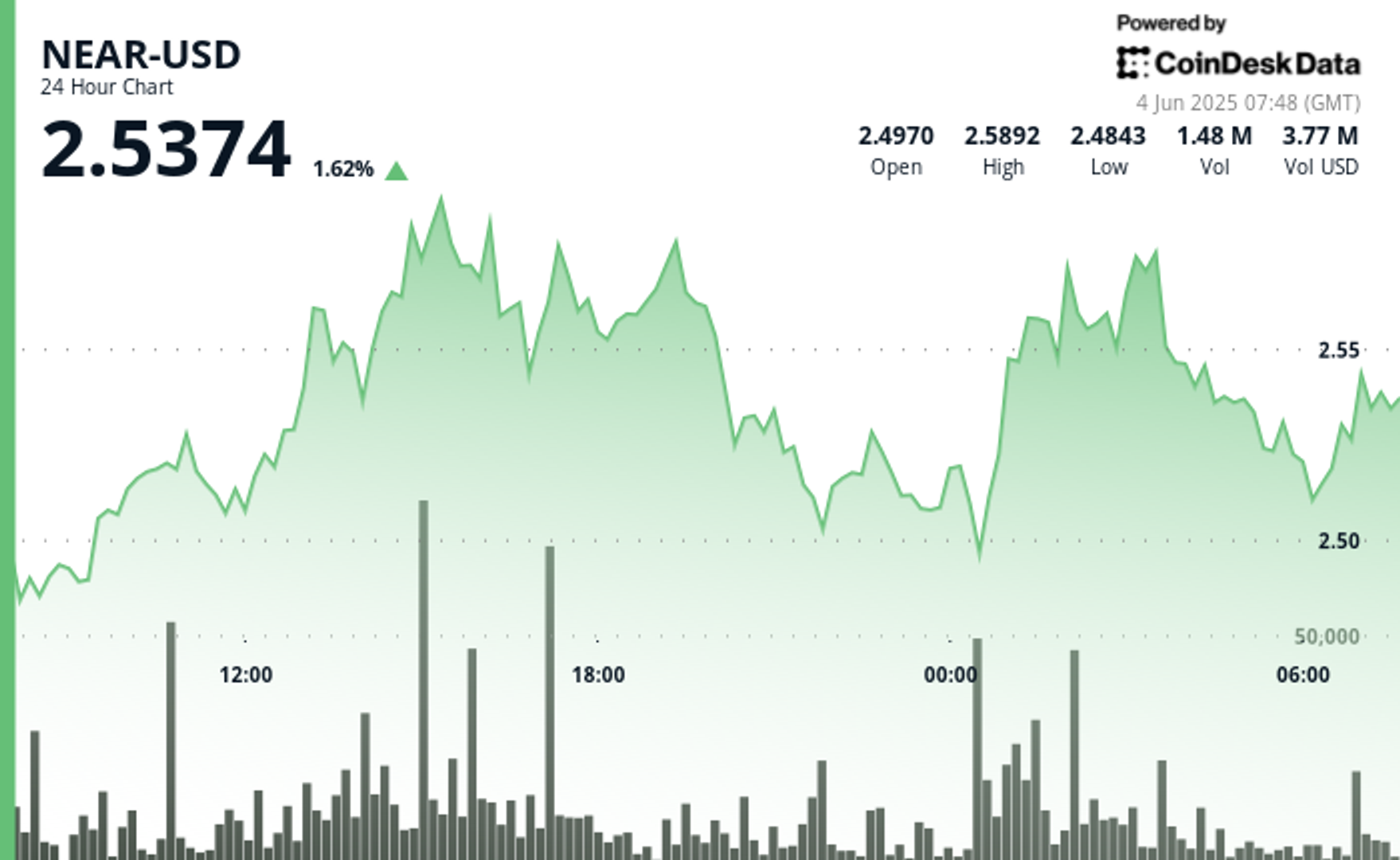

- Notable volume surge occurred during the 13:00-15:00 timeframe when price broke above the $2.53 resistance level, with volume exceeding 3 million units in consecutive hours, confirming strong buyer conviction.

- Price action formed a cup-and-handle pattern with support established at $2.49-$2.50, while the late session recovery from the 21:00 dip suggests renewed buying interest.

- In the last hour, NEAR-USD continued its bullish momentum with a significant price surge from $2.541 to $2.562, representing a 0.82% increase.

- A notable breakout occurred at 01:25-01:26 when price jumped above $2.55 with volume exceeding 116,000 units, confirming strong buyer conviction.

- The hourly chart shows the formation of an ascending channel with support at $2.547 and resistance at $2.562, suggesting potential continuation toward the $2.58-$2.60 range if current momentum persists.

Leave A Comment