Pulse.inc announces a change to the methodology of the DeFi Pulse Index to be effective at the December 2021 rebalancing.

The DeFi Pulse Index is a digital asset index designed to track the performance of some of the largest protocols in the Decentralized Finance (DeFi) space.

Pulse.inc updates the capping rule that is part of the weighting scheme of the index. The current rule in methodology v0.3 states that any token that has a weight greater than 25% during the Determination Phase will have its weight capped at 25%.

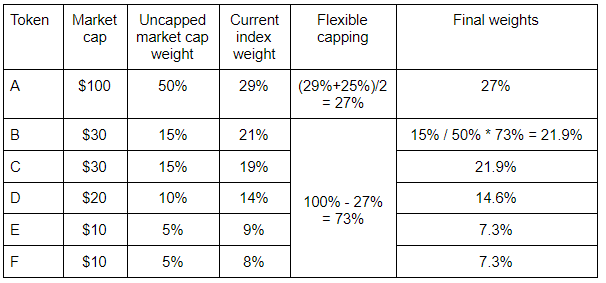

The methodology update to v0.4 will modify this rule to incorporate a Flexible Capping:

Any token that has a weight greater than 25% based on its market cap during the Determination Phase will have its weight capped. The target weight of the capped token will be the average of its current index weight and 25%.

Why Flexible Capping?

Pulse.inc had first introduced the 25% single constituent capping for the DeFi Pulse Index during its March 2021 rebalance in order to ensure that the index provides diversified exposure to the DeFi market after UNI, Uniswap’s governance token, had rallied. If not capped, UNI would have reached a market cap weight of more than 50% otherwise.

The downside of capping a market cap weighted index is that it creates turnover. Next to representing the economic reality of the underlying target market, investability is another important goal of blue-chip or benchmark indices such as the DeFi Pulse Index.

A market cap weighted index without additions or deletions of constituents has in theory no turnover at a rebalancing unless circulating supply of a token changes or a token weight is capped.

The majority of turnover of the DeFi Pulse Index had been induced by monthly setting UNI’s weight back to exactly 25%. Furthermore, every UNI turnover due to capping causes an equal amount of weight changes across all other constituents: E.g. if a constituent is capped from 27% to 25%, 2 percentage points have to be proportionally distributed amongst all other constituents.

Introducing Flexible Capping reduces this turnover induced by capping. In the above example UNI’s capped weight would not be 25% but instead only half way from 27% to 25%, i.e. it would be capped at 26%. UNI turnover is cut in half and the equivalent turnover across all other constituents that get the capped amount distributed is also halved.

At the same time the index remains well diversified and the weighting proportional to market caps for all uncapped constituents remains.

See below for a hypothetical example:

The one-way turnover, , using Flexible Capping is 4.4%. Without Flexible Capping it would have been 6.0%.

As a result of reduced index turnover, implementations of the index methodology such as Index Coop’s DPI token have to trade less at a rebalance and can decrease maintenance costs.

Pulse.inc, a subsidiary of DeFi Pulse, is dedicated to creating and maintaining indices for a decentralized world.

The post Methodology change DeFi Pulse Index: Introduction of Flexible Capping appeared first on Defi Pulse Blog.

Leave A Comment