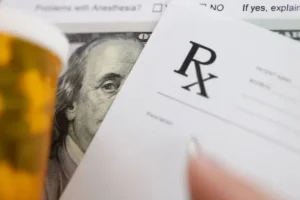

A Houston, Texas man, Mohamad Mokbel (59-years old), was convicted on Tuesday for orchestrating a complex fraud scheme that stole more than $160 million from Medicare by billing for unnecessary medications, the DOJ reported. A federal jury found Mokbel guilty on all 15 charges, including healthcare fraud, mail fraud, money laundering, bribery, and conspiracy to violate the Anti-Kickback Statute, after a swift 10-day trial.

From 2014 to 2021, Mokbel led a network of pharmacies called, “4M Pharmaceuticals,” through which he defrauded Medicare. The scheme involved the illegal purchase of patient information and the submission of fraudulent insurance claims for medications that patients never requested. “He turned pills and creams into liquid gold.” Prosecutor Adam Goldman told the jury in his opening statement.

Mokbel primarily targeted elderly diabetic patients, using their Medicare identification numbers and personal health information to bill for prescriptions such as expensive topical creams and Omega-3 pills that were often unnecessary. The scam relied on faxing pre-filled prescription requests to doctors, appearing to be for diabetes testing supplies but including additional medications. Many doctors, unaware of the scam, signed off on these requests, which allowed Mokbel’s pharmacies to bill Medicare for drugs the patients did not need.

Former employees of 4M Pharmaceuticals testified about the scale of the scheme. Parris Rhodes, a former sales manager, recalled reaching out to thousands of patients to confirm their mailing addresses. “The patients would say, ‘you’ve maxed out my insurance,’” Rhodes testified and described the confusion many patients felt after receiving medications they never ordered.

In addition to exploiting Medicare, Mokbel is alleged to have bribed an employee at pharmacy benefit manager OptumRX with over $188,000 in exchange for favorable treatment, which allegedly helped 4M Pharmaceuticals avoid audits and remain in the Medicare Part D network. Mokbel’s defense argued that these payments were legitimate business gratuities and that Mokbel’s actions were within legal bounds, but the jury was not persuaded.

Cindy Hanson, 4M’s bookkeeper, said that she believed the company was engaged in unethical behavior to overcome audits, including creating fake checks to make it appear patients had paid their copays. Hanson’s testimony, alongside others, helped seal the case against Mokbel. As prosecutor Goldman stated in his closing argument, “Lying, cheating, and stealing is not OK because you think the industry is unfair.”

Mokbel was immediately taken into custody following the verdict, despite previously being released on bond. He now faces up to a staggering 150 years in prison, with sentencing set for early 2025. Mokbel could be ordered to pay up to an additional $4 million in fines and restitution on top of the $160 million.

Through the coordinated efforts of multiple federal agencies, including the FBI, IRS Criminal Investigation, and the Department of Health and Human Services, Mokbel’s operation was exposed, bringing an end to a fraud scheme that harmed thousands of vulnerable people.

Whistleblowers are essential in uncovering misconduct like this case. If you have any information of Healthcare Fraud that directly impacts Medicare and would like to speak to an experienced member of the Constantine Cannon whistleblower lawyer team, please do not hesitate to reach out and contact us for a free and confidential consultation.

Read Houston Pharmacy Owner Convicted in $160 Million Medicare Fraud Scheme at constantinecannon.com

Leave A Comment