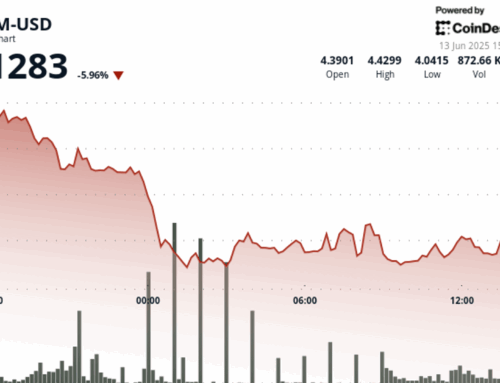

SharpLink Gaming (SBET), a Nasdaq-listed company that is pursuing an ether ETH treasury strategy, tumbled 70% on Thursday in after-hours trading following a fresh filing to the U.S. Securities and Exchange Commission.

The company submitted an S-3ASR registration statement, enabling the resale of up to 58,699,760 shares related to its private investment in public equity (PIPE) financing.

The Thursday filing allows more than 100 shareholders in the PIPE round to sell their shares, effectively flooding the market and triggering a post-close sell-off, Charles Allen, CEO of BTCS, a publicly-traded firm that’s pursuing crypto reserve strategy centered on bitcoin BTC, explained in an X post and an interview with CoinDesk.

The company raised $450 million earlier this month through a PIPE round from a wide range of investors, including ConsenSys, Galaxy, and Pantera Capital, to acquire ETH for its treasury. Ethereum co-founder and ConsenSys CEO Joseph Lubin also joined the firm as board chairman.

However, there may be a larger strategy behind the latest move.

Allen said in an X post that he thinks the company may have quietly raised up to $1 billion to buy more ETH using an at-the-market (ATM) offering that was previously announced in a May 30 SEC filing.

“If they played cards right, they would expect a surprise PR tomorrow with $1B of ETH purchases, which could light the match to reignite the stock,” he said.

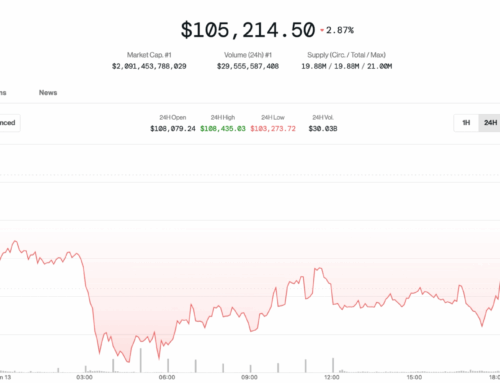

ETH is down 4.1% over the past 24 hours at around $2,650 as bitcoin and the broader crypto markets slid.

Read more: Crypto Cracks Late in Day, Bitcoin Slumps Below $106K

Leave A Comment