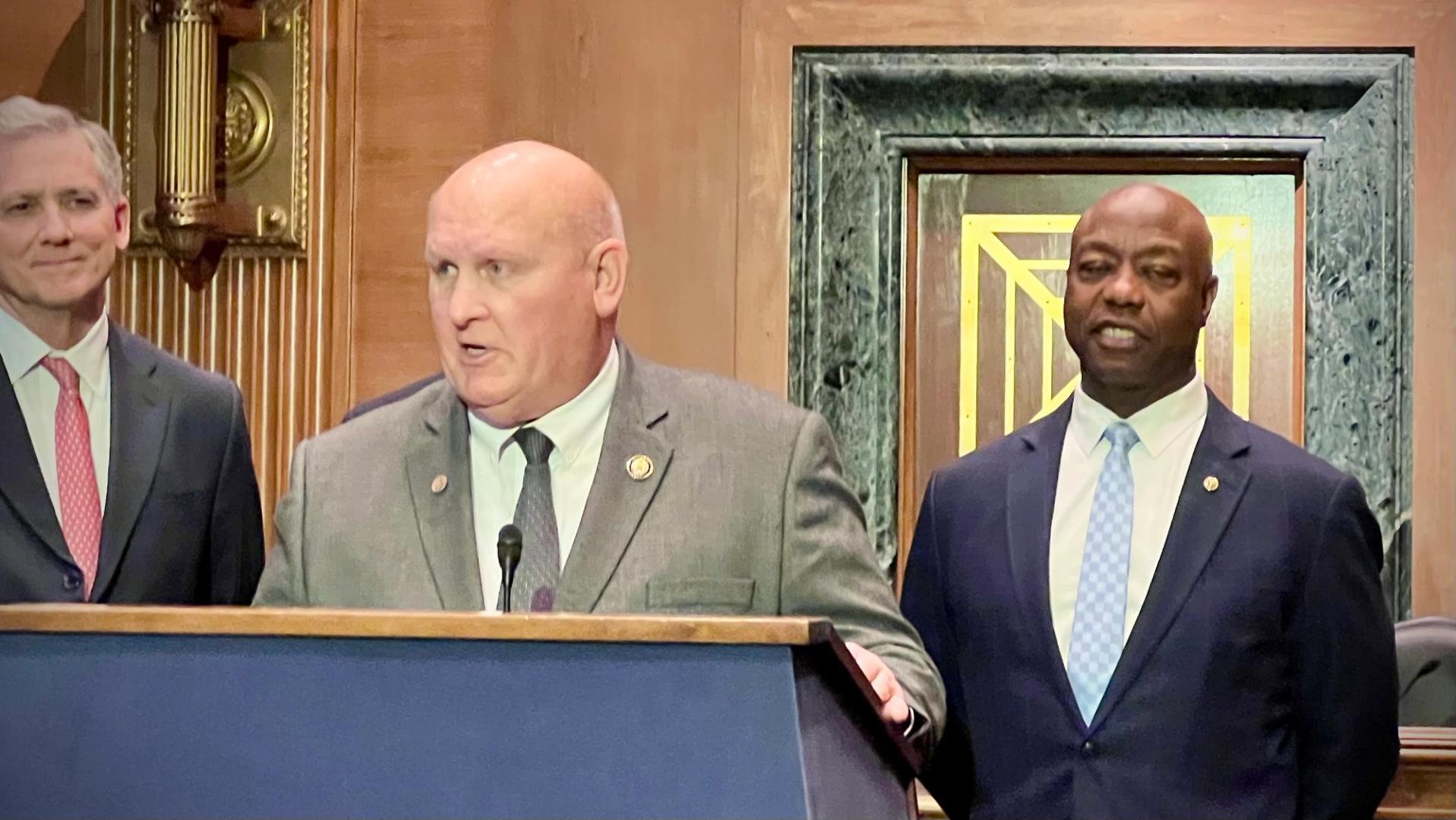

Trump’s CFTC Pick Says U.S. Can Boost Crypto Innovation and Shield Consumers

President Donald Trump's pick to be chairman of the U.S. commodities watchdog, Brian Quintenz, fielded crypto questions more than any other topic at his Senate confirmation hearing on Tuesday, and he assured the lawmakers that the agency can walk a middle ground between unhampered innovation and robust consumer safeguards. Even [...]