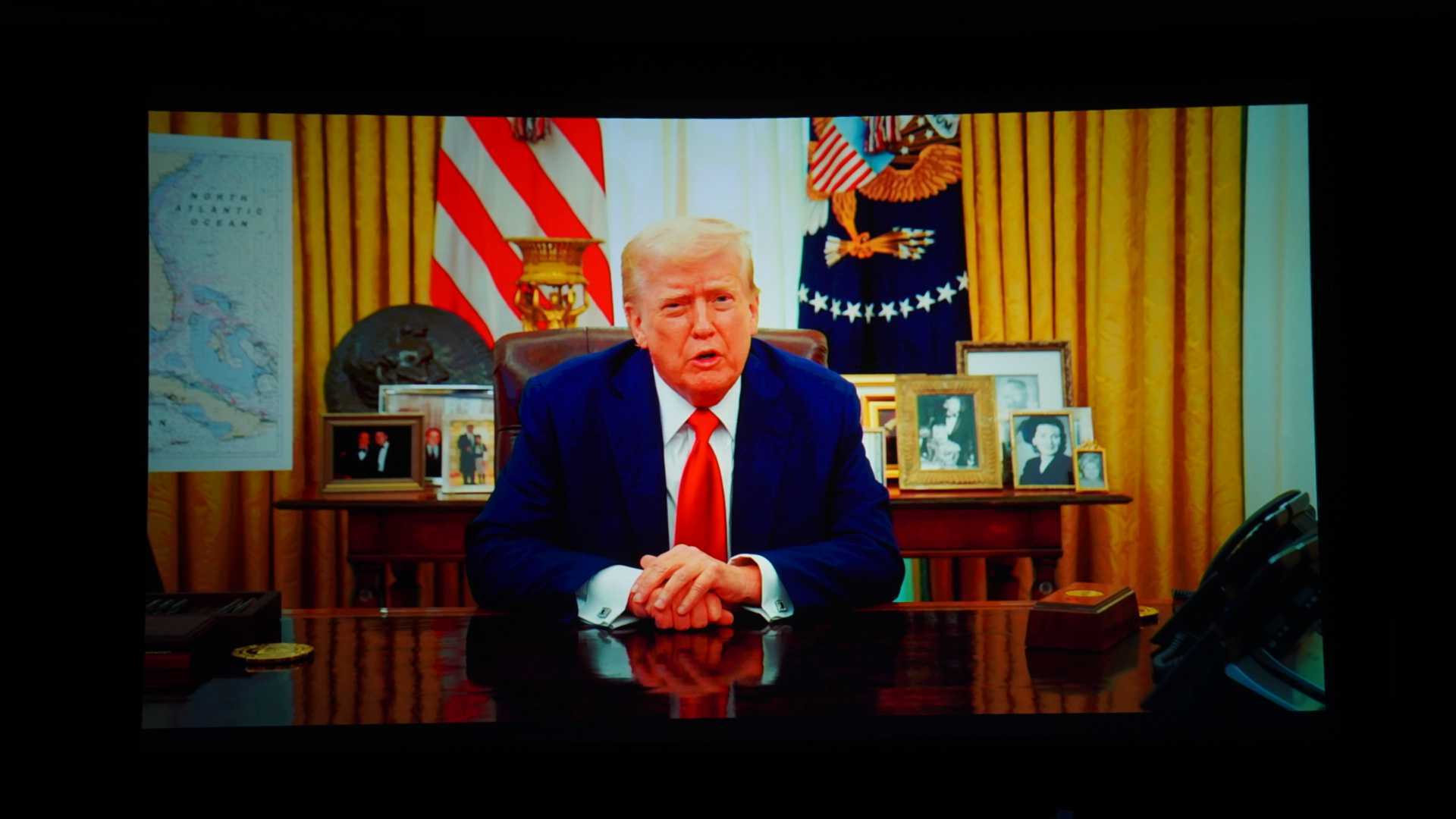

Crypto Outperforms Nasdaq as BTC Becomes ‘U.S. Isolation Hedge’ Amid $5T Equities Carnage

President Donald Trump’s reciprocal tariff unveiling had led to a $5.4 trillion U.S. equities market wipeout in just two days as the S&P 500 index dropped to its lowest level in 11 months and the Nasdaq 100 entered bear market territory. Yet, amidst the chaos, cryptocurrency prices are showing resiliency, [...]