NEAR Protocol Surges 5% After Forming Bullish Support Pattern

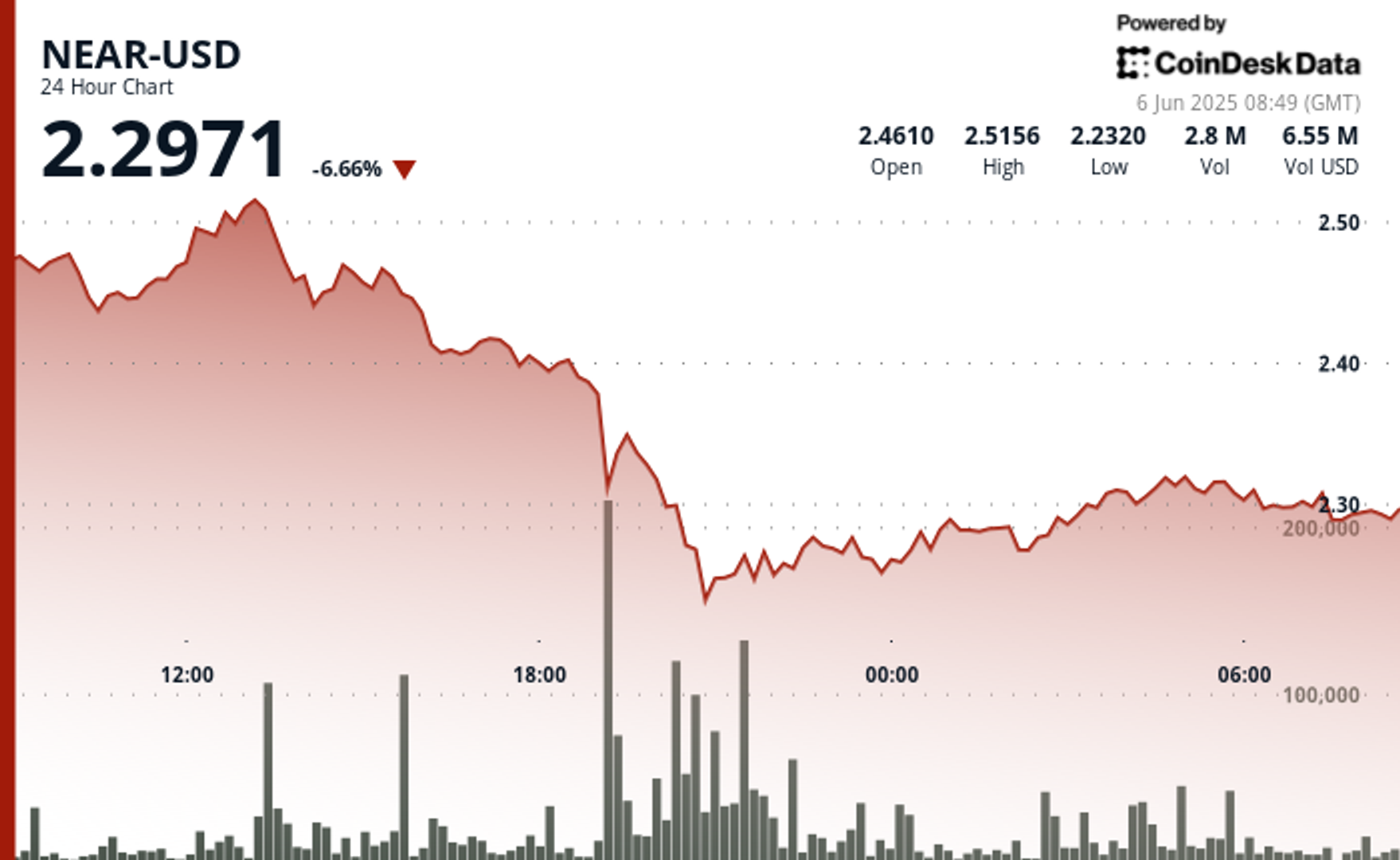

Global markets are navigating heightened uncertainty following a public spat between U.S. President Donald Trump and Tesla CEO Elon Musk. NEAR Protocol has demonstrated resilience amid this volatility, recovering from a sharp 5.2% decline to establish support at $2.42. The recent price action shows promising signs of accumulation, with increasing [...]