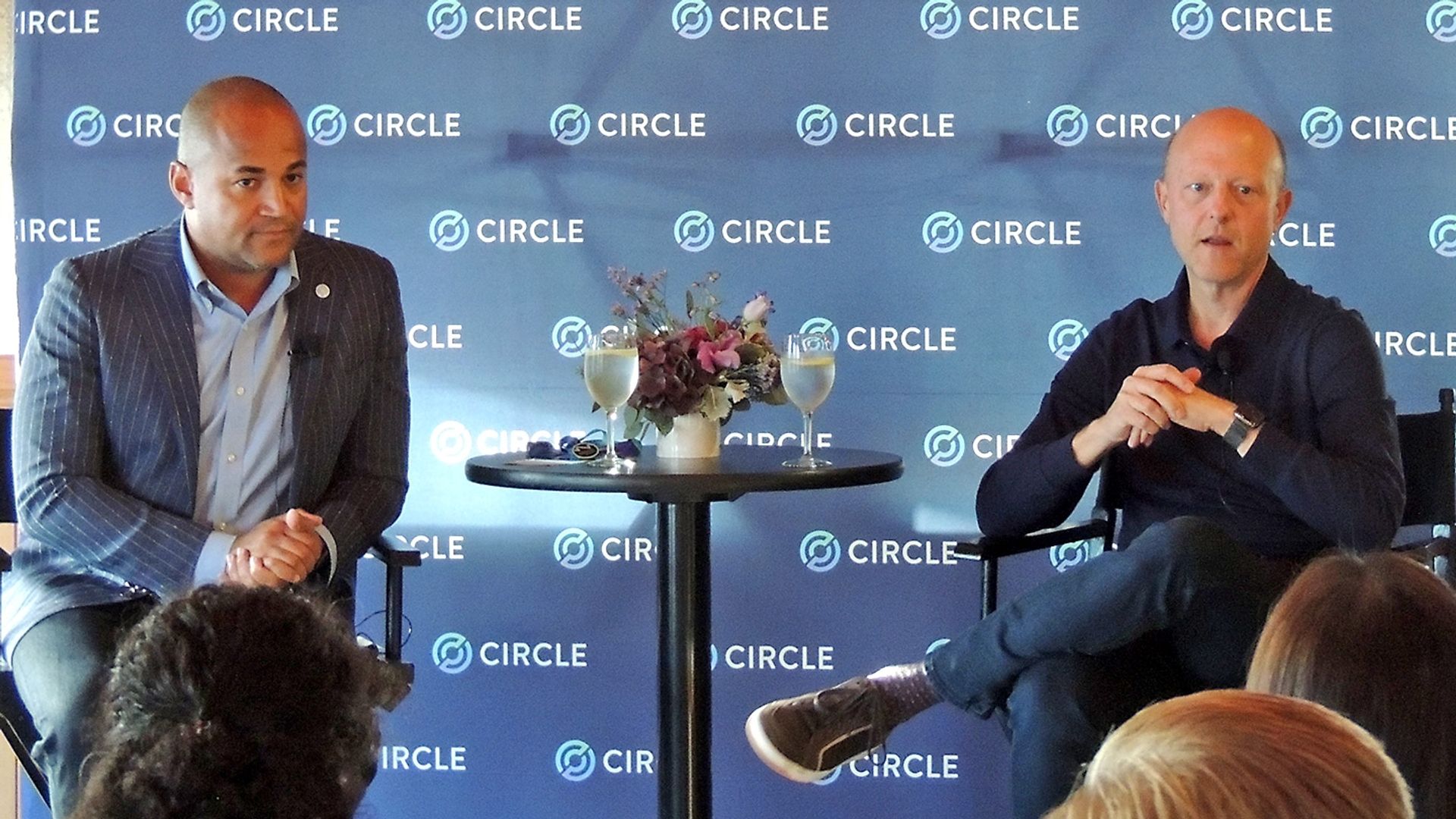

Weekly Recap: Circle Scores Big on IPO Fever

It was a week of fortunes made, and fortunes lost, at CoinDesk.On the one hand, we had Circle, long a leading crypto company, hurtling to IPO and making bank. Its shares were priced at $110 at press time (up from $31 Wednesday), leading many to expect a summer and fall [...]