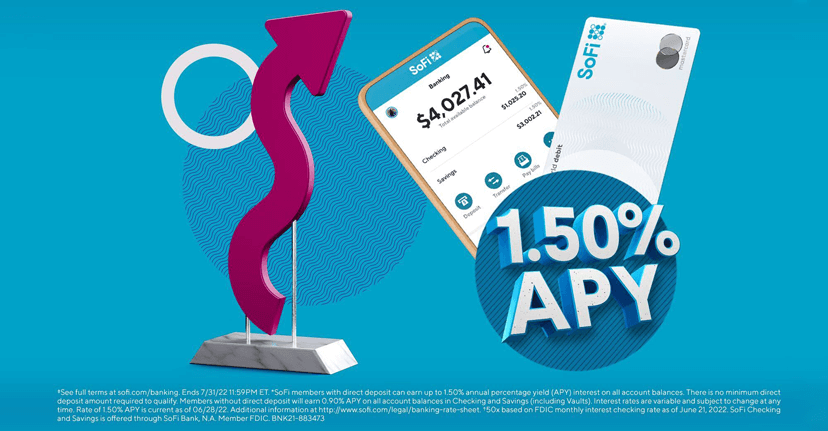

SoFi members, rejoice: SoFi Checking & Savings is helping people earn more off their hard-earned money by raising our industry-leading annual percentage yield (APY)¹ for all members. Members with direct deposit will now earn 1.50% APY on their balances, 50 times the current national average². For members without direct deposit, all balances will now earn .90%, 30 times the national average³.

SoFi has no caps on money that can earn interest, so you are able to make money on every dollar you have in your SoFi Checking & Savings account.

Since launching SoFi Checking & Savings in February, this is the second time we’ve raised our APY to help members get the most out of their money. According to our recent SoFi Money Habits Survey, almost half of members report strained wallets, saying they are spending 10-20% more on average due to inflation⁴. We’re committed to putting money back in members’ pockets to help them get their money right and make their lives easier right now.

Interested in earning more? Sign up for SoFi Checking & Savings. Already a member? Set up your SoFi direct deposit to make sure you get the most out of your money.

¹SoFi members with direct deposit can earn up to 1.50% annual percentage yield (APY) interest on all account balances in their Checking and Savings accounts (including Vaults). Members without direct deposit will earn 0.90% APY on all account balances in Checking and Savings (including Vaults). Interest rates are variable and subject to change at any time. Rate of 1.50% APY is current as of 06/28/2022. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet

²50x based on FDIC monthly interest checking rate as of June 21, 2022.

³≥30x based on FDIC monthly interest checking rate as of June 21, 2022.

⁴The SoFi Money Habits Survey was fielding via the Qualtrics platform, surveying over 2,400 SoFi members across May and June 2022.

The post Max Your Money: SoFi Raises APY to 1.5% for Direct Deposit Members appeared first on SoFi.

Leave A Comment